Fixed Income Investments

Be it Individuals, Trusts, Corporates or any other Entities- we can cater your need of Fixed Income Investments. Our Fixed Income Investment Solutions are provided keeping in mind client’s income tax, cash flow & liquidity needs.

Fixed Income investments can be bought both on Primary Markets (from the issuer itself) & Secondary Markets (from the investor- who is selling the security in the market). Our expertise lies in providing you solutions that aligns with; your portfolio & cash flow requirement, finding the best of deal & seamless transactions.

Currently available Investment Options- PDF to be updated every month

Types of Bonds & Deposits

- Fixed Rate Bonds: It has a fixed Coupon or Interest which will be paid till the maturity of the bond. Interest paid on such bonds can be taxable or tax-free. Both the kinds of Bonds can be issued by Public Sector Undertakings, Government of India, Reserve Bank of India, etc.

- Zero Coupon Bonds: These bonds do not pay periodic interest or coupon rate but is effectively rolled up to maturity and bond holder receive full principal amount at the redemption date.

- Perpetual Bonds: These bonds are also often called perpetuities or 'Perps'. They have no maturity. However they have a call/put date as per the structure of the Instruments.

- Convertible Bonds: Here the bondholder can exchange a bond to a number of shares of the issuer's common stock.

- Capital Gain Bonds (u/s 54 EC): Capital Gain Bonds are being issued as 'Long term specified assets' within the meaning of Sub-Section 54-EC of the Income Tax Act, 1961. The entire capital gain realized is invested within 6 Months of the date of transfer in eligible bonds.

- Interest Income is Taxable

- Tenor of the bonds is for 5 years

- Maximum Investment limit is Rs. 50 Lakhs

- Sovereign Gold Bonds Scheme:

- Issued by Government of India

- Regular Interest Income

- Redemption is linked to gold price

- Tenor of 8 yrs, with exit option 5th yr onwards

- Elimination of storage Cost. Online investment option

- Corporate Deposits: A Corporate Fixed Deposit (FD) is an investment in a company for a fixed period at a prescribed rate of interest. Both, Financial and Non-Banking Finance Companies (NBFCs) raise capital via such deposits. Credit Rating, tenor, interest rate, etc. varies from deposit to deposit. And should be considered at the time of investment. These deposit usually offer higher interest rate compared to Bank Deposits.

- Foreign Bonds: One can invest into Foreign Bonds of Indian Entities. Such bonds provide hedge against currency and fixed income. Such bonds are subject to availability.

Key Terms

- Coupon: The Interest rate on a bond is the annual percentage of its par value that will be paid to bondholders. Some bonds pay interest at a regular interval, while some pay no interest prior to maturity and are called zero-coupon bonds.

- Maturity: The maturity date of a bond is the date on which the principle is to be repaid.

- Price: Bond investors have two key price concepts to conside -

- Market Price: The currently quoted bond price. There will be a price that the buyer can purchase at - “Ask Price”, and usually a price at which they can sell at - “Bid Price”.

- Par Value: The stated value of a bond-typically eg. Rs. 1,000/- also known as face value. Bonds are usually issued and mature at par (i.e.: at maturity the bond holder receives Rs, 1,000/- per bond)

Bond prices are quoted as a percentage of par-

The par value of Rs.1000/- is quoted as “100.00”. Market prices vary around that so a bond with an Ask Price of “99.00” is asking the investor to pay: 99% of Rs1,000 = Rs.990” - Yield: The anticipated return on an investment, expressed as an annual percentage.

– It takes into account the purchase price, the anticipated coupons or cash flows over the life of the bond, and the return of principal on bond’s maturity.

– Example: An 8% yield means the investment averages an 8% return each year.

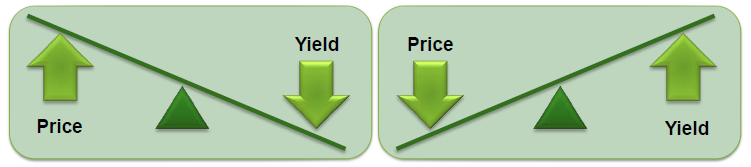

Also, a bond’s yield is inversely related to its price as the price moves up, the quoted yield of the bond moves down.

- Modified Duration: Duration measures how sensitive a bond’s price is to changes in the level of current interest rates in the markets

Types of Risks Associated:

Some of the risks related to fixed income securities that one needs to keep in mind:

- Credit Risk: It is the risk associated with losses arising from failure of a borrower to make timely and full payments of interest or principle. The risk is minimal in government bonds.

- Interest Rate Risk: When interest rate are rising, bonds price falls and vice-a-versa. There is inverse relationship between the price and the interest rate in the market.

This happens because when interest rates are on decline, investors try to capture or lock in the highest interest rates and will tend to buy more existing bonds that pay higher interest rate than the prevailing market rate. The increase in demand translate into an increase in bond price. On the flip side, if the prevailing interest rate were on the rise, investors would naturally get rid of bonds that pays lower interest rates. This would force bond prices to fall. - Reinvestment Risk: Is the risk of having to reinvest interest income or any return of principle, at a lower interest rate, in a declining interest rate scenario.

- Inflation Risk: Increasing inflation reduces the purchasing power of an investor’s future cash flows from bonds (interest income & principle)

- Liquidity Risk: The risk of inability to find a buyer for a bond when the investor needs to sell, or the risk of having to sell a bond at a significant discount to prevailing market.

“Insurance is the subject matter of solicitation"

MADHUVAN INSURANCE BROKING – An IRDA recognized Insurance Broking House